In this masterclass, Quickchannel’s CEO Victor Underwood sat down with two experienced practitioners in financial video communication:

- Christoffer Sapienza, Creative Lead at DNB, responsible for creative productions, events, and marketing content.

- Wilhelm Edfalk, Head of Studio at DNB Carnegie, with 10+ years producing financial webcasts, quarterly reports, and capital markets days.

Together, they shared how leading financial institutions use video to communicate complex information, build trust, and drive real business outcomes—while maintaining the quality and compliance demanded in finance.

View the masterclass on-demand

TL;DR – Key takeaways from the masterclass

Why video matters in finance

- Finance has complex information, strict regulation, and high trust demands.

- Effective financial video must prioritize:

- Engagement & interactivity (for live; Q&A, CTAs, polls, chat)

- Brand consistency & quality

- Compliance & accessibility from day one.

How DNB uses video strategically in the marketing mix

- DNB maps audiences by motivation and knowledge (low/high) and chooses format accordingly:

- Low motivation / low knowledge → Engage

- High motivation / low knowledge → Explain

- High motivation / high knowledge → Tell

- Low motivation / high knowledge → Convince

- They mix live, hybrid, simulated live, and on‑demand formats based on audience and goal.

- Every video/event has clear cognitive, social, action, and financial objectives.

How DNB uses storytelling for financial content

- Use a simple structure: tell them what you’ll say → say it → recap it.

- Adjust depth and jargon to the audience’s knowledge level.

- Keep videos short and focused, leaving viewers wanting more (and prompting further exploration).

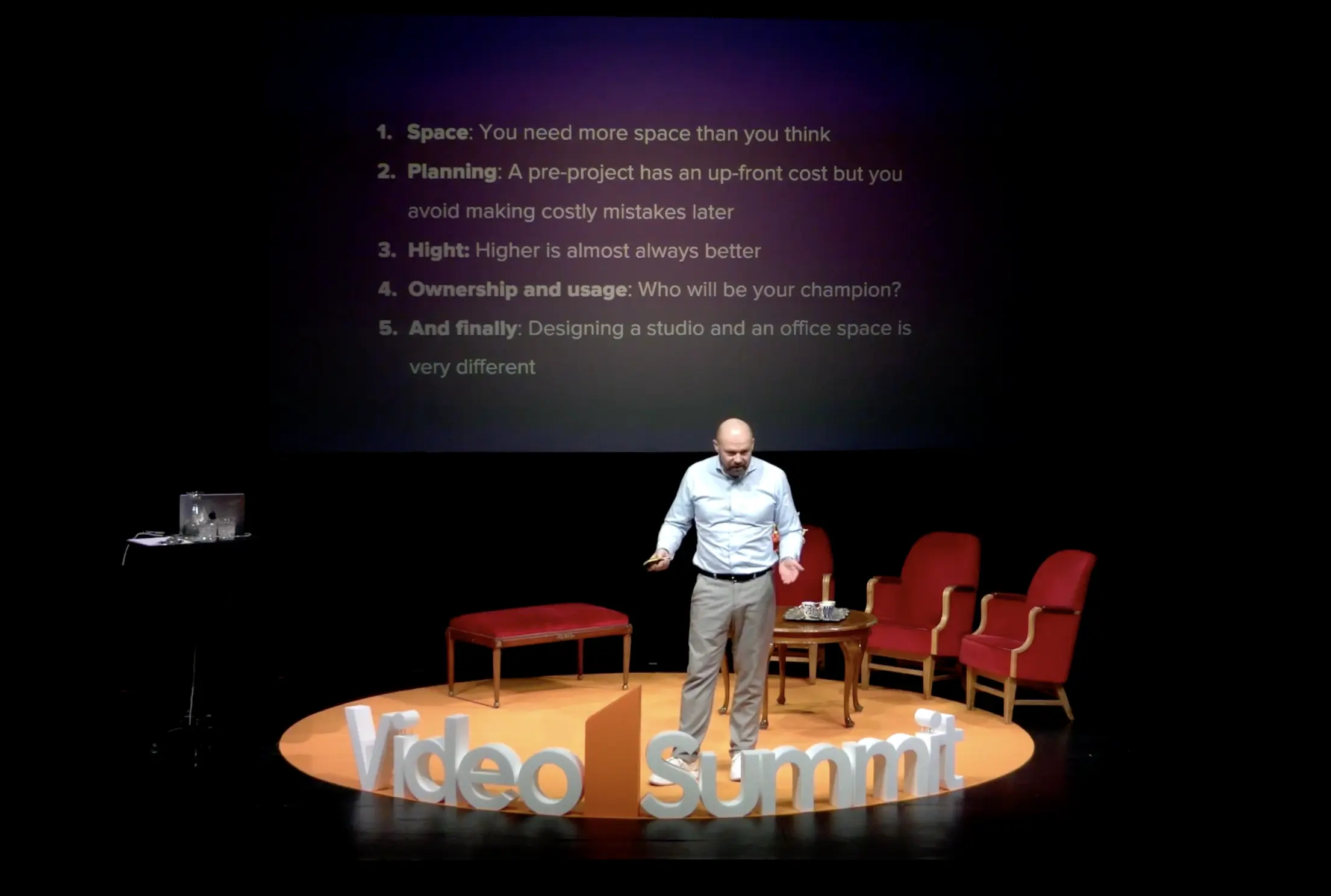

DNB Carnegie’s video production best practices

- Audio matters more than image quality for viewer retention and trust.

- Build redundancy everywhere:

- Backup mics, backup internet (e.g., 4G/5G failover), ISO recording of all sources.

- Have a clear Plan B for technical failures (what to do if stream or hardware fails).

- All tech should be ready before speakers arrive so you can focus on them, not the gear.

Read our customer case with DNB here

Making non‑media people comfortable in-front of the camera

- Most finance experts never planned to be on camera—your calmness and preparation reduce their stress.

- Explain simple backup plans (e.g., spare handheld mic) and normalize small mistakes.

- Give speakers time on set to familiarize themselves with cameras, clicker, and flow.

Microphones and noise management

- In noisy environments, use headset mics rather than lavaliers; they’re more directional.

- Use noise gates and EQ in your mixer to cut constant background noise.

- If live can’t be perfect, clean the audio in post and upload a better on‑demand version.

Coaching slides and visuals

- Financial decks are often too dense: tiny fonts, overloaded charts.

- Review and challenge decks in advance:

- Split complex slides

- Use slides to support what’s said, not replace it.

- Use full‑screen slides for detailed tables, and be deliberate with picture‑in‑picture.

Using AI safely in finance

- Banks “sell trust,” so AI use must be transparent and governed.

- Good current use cases:

- Auto‑transcription, translation, captions

- Audio enhancement and faster editing

- Be cautious with synthetic avatars/voices and never generate brand assets (like logos) via prompts.

Measuring success (KPIs)

- Track both quantitative and qualitative metrics:

- Views, completion, click‑through, funnel impact, sales

- Surveys on understanding, usefulness, length, likelihood to recommend

- Think in terms of return on objectives (knowledge, relationships, actions, financial results), not just views.

Contact us to learn more

Reach out to learn how Quickchannel can help your organisation succeed with video.